*Medical Cost Increase in India: Trends, Projections, and Mitigating Strategies*

(A Report by Mercer Marsh)

The Indian healthcare landscape is witnessing a significant surge in medical costs, impacting individuals, families, and organizations alike. Mercer Marsh’s latest study reveals alarming trends and projections, highlighting the need for proactive measures to mitigate the financial burden.

*Key Findings:*

1. *Double-Digit Inflation*: Medical costs in India have consistently outpaced general inflation, with an average annual increase of 12-15% over the past five years.

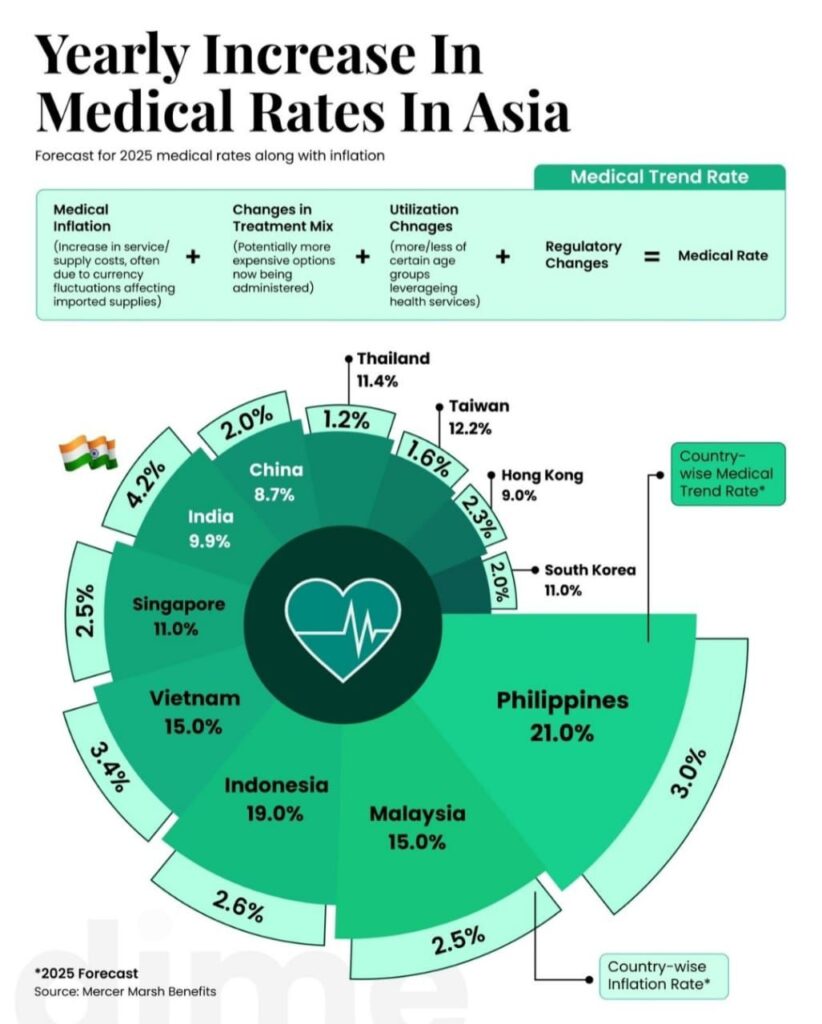

2. *Highest Increase in Asia Pacific*: India’s medical inflation rate surpasses that of other Asian countries, including China (8-10%), Singapore (6-8%), and Japan (4-6%).

3. *Hospitalization Costs*: In-patient hospitalization costs have risen by 15-20% year-over-year, driven by increased room rates, surgical procedure costs, and diagnostic expenses.

4. *Pharmaceutical Prices*: Medication costs have escalated by 10-12% annually, fueled by rising input costs, research investments, and regulatory changes.

5. *Outpatient and Diagnostic Costs*: Outpatient consultation fees and diagnostic test prices have increased by 10-15% and 12-18%, respectively.

*Drivers of Medical Cost Increase:*

1. *Aging Population*: India’s growing elderly population contributes to increased healthcare demand and costs.

2. *Lifestyle-Related Diseases*: Rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, drives medical spending.

3. *Advances in Medical Technology*: Adoption of cutting-edge treatments and equipment escalates costs.

4. *Shortage of Healthcare Professionals*: Increased demand for skilled healthcare workers leads to higher labor costs.

5. *Regulatory Changes*: Government policies, such as price controls and taxation, impact pharmaceutical and medical device pricing.

*Projections and Implications:*

1. *Continued Double-Digit Inflation*: Medical costs are expected to rise by 12-15% annually for the next three years.

2. *Increased Burden on Employers*: Organizations will face higher healthcare costs, affecting employee benefits and overall competitiveness.

3. *Growing Out-of-Pocket Expenses*: Individuals and families will bear the brunt of increasing medical costs, exacerbating financial stress.

*Mitigating Strategies:*

1. *Health Insurance*: Investing in comprehensive health insurance plans to share risk.

2. *Wellness Initiatives*: Encouraging preventive care and healthy lifestyles.

3. *Cost-Effective Treatments*: Promoting affordable, high-quality medical options.

4. *Digital Health Solutions*: Leveraging technology for remote consultations and monitoring.

5. *Public-Private Partnerships*: Collaborating to improve healthcare infrastructure and accessibility.

*Case Studies:*

1. *Employee Benefits*: Companies like Infosys and Wipro have implemented comprehensive health insurance plans, reducing employee out-of-pocket expenses.

2. *Government Initiatives*: The Ayushman Bharat Yojana provides health coverage to economically vulnerable families, mitigating financial risk.

*Conclusion:*

As medical costs continue to rise in India, stakeholders must adapt and innovate to ensure affordable, quality healthcare. By understanding the drivers of medical inflation and implementing proactive strategies, we can mitigate the financial burden and promote a healthier, more resilient community.

*Recommendations:*

1. *Regular Health Check-Ups*: Encourage preventive care to detect health issues early.

2. *Health Education*: Promote awareness about healthy lifestyles and disease management.

3. *Telemedicine*: Leverage digital platforms for remote consultations.

4. *Healthcare Financing*: Explore innovative financing models, such as health savings accounts.

*Sources:*

– Mercer Marsh’s Medical Cost Survey (2022)

– Indian Healthcare Industry Report (2022)

– World Health Organization (WHO) Data

– National Health Profile (NHP) Report

*About Mercer Marsh:*

Mercer Marsh is a leading global consulting firm, providing expertise in healthcare, risk management, and employee benefits. Our research and insights help organizations navigate complex healthcare landscapes, optimizing their investments and improving outcomes.